What is EDLI scheme in EPF?

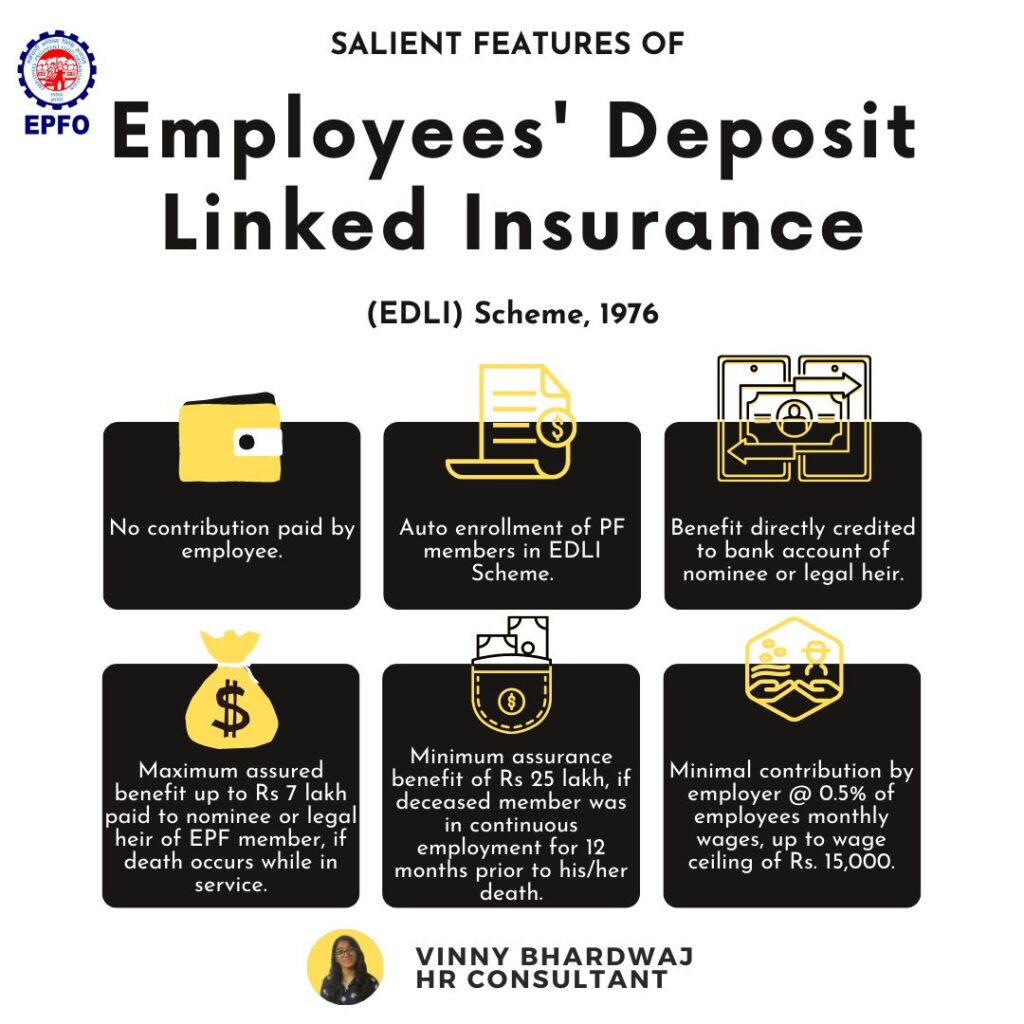

The Employees’ Deposit Linked Insurance (EDLI) Scheme is an insurance scheme provided by the Employees’ Provident Fund Organization (EPFO) in India. It provides life insurance coverage to the employees of organizations that are registered under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. The primary purpose of the EDLI scheme is to provide life insurance benefits to employees in the organized sector, in case of their untimely demise while they are still employed.

The EDLI scheme serves as a form of social security for the dependents of employees, providing financial support to the family in the event of the employee’s death. It helps to ensure that the family members of the insured employee are provided with some financial stability during difficult times.

Who is eligible for EDLI scheme?

There are certain criteria that must be met for eligibility under the EDLI scheme:

- The organization must be registered under the EPF and Miscellaneous Provisions Act, 1952.

- All employees who are members of the EPF are covered, provided the organization is covered under the EPF scheme.

- The employee should have an active EPF account, and the employer must be making regular contributions to the EPF on the employee’s behalf.

EDLI calculation

The calculation of the Employees’ Deposit Linked Insurance (EDLI) is based on the monthly wages of the employee. The insurance cover under the EDLI scheme is equivalent to 30 times the average monthly salary of the employee over the preceding 12 months, capped at ₹15,000, which determines the base coverage amount. Additionally, a bonus of ₹2.5 lakhs, increased from ₹1.5 lakhs since September 2020, is included with the coverage.

Therefore, for salaries exceeding ₹15,000, the total benefit can be calculated as :

30* ₹15,000 + ₹2.5 lakhs = ₹7 lakhs

If the salary is below ₹15,000, for instance, ₹10,000, the benefit payable under the EDLI insurance would be:

30 *₹10,000 + ₹2.5 lakhs = ₹5.5 lakhs

How to make a claim under EDLI?

To initiate a claim, the nominee or the legal heir of the employee is required to submit the prescribed documents to the EPFO department:

- Composite Claim Form in Death Cases

- Death certificate of the employee.

- Succession certificate in cases where the legal heir is filing the claim

- Guardianship certificate if the claim is filed on behalf of a minor by someone other than the natural guardian

- A copy of a cancelled cheque for the claim amount to be credited.